Bankrate credit card page engagement

Improved Bankrate’s credit card page experience through clearer structure and new components, increasing engagement and lifting click-through rates by 20%.

Role

Associate Product Designer

Skillset

Figma, Product Strategy

Team

2 Designers, 2 PMs

Timeline

2024-2025, 13 months

Jump to solution

OVERVIEW

Bankrate’s credit card category pages are seeing a significant decline in engagement. Our team wanted to diagnose the issue and deliver a solution that would help engage more users while still keeping the focus on the largely transactional nature of the page.

problem framing

Credit card category pages are losing engagement

Bankrate’s credit card category pages significantly decline in engagement past the 5th featured credit card in the form of click through rate (CTR) and conversion rate (CR).

While it’s normal to assume that the amount of users that view each product further down the page may decrease, there is something that is causing a drop in viewers and massive drop off in conversion rate (~88%) past the 5th featured credit card.

product analysis

Understanding what our users actually want

Revisiting our credit card category pages and combing over user research regarding credit card users’ intents revealed 2 main insights:

1

Users always want to see the most relevant and personalized information to their own situation.

2

Users are arriving on credit card category pages with many different intents.

diagnosis

What is broken about the current experience?

The credit card category page is optimized almost entirely around featuring cards and their benefits.

While this works for users who know exactly what they want, it falls short for those who arrive with different intents—such as learning how to use a card in a specific category or deciding which card is right for them.

After the first few top-ranked cards, additional cards provide diminishing value, making it harder for users to confidently choose or move forward.

Cards 1-5

Highly relevant results

Users are generally looking for these results.

Limited-time offers

High-scoring reviews

Great benefits

Cards 6 & 7

Slightly relevant results

These results may be relevant for niche audiences.

Niche callouts

Average reviews

Average benefits

Cards 8-14

Rarely relevant results

These results are likely irrelevant for most users.

Lower-scoring reviews

Below-average benefits

strategy exploration

Evaluating two strategic solutions

To address the key insights uncovered earlier and improve engagement on Bankrate’s credit card category pages, I explored two strategic approaches: each designed to support different user intents and business priorities.

1

Intent-led Approach

Focus primarily on addressing each user’s intent and triage their needs early on in the page.

2

Transactional Approach

Primarily target the users who are ready to convert by engaging them with content that will aid their decision-making process.

final solution

Prioritizing high-intent users

After reviewing both approaches with stakeholders, we chose to prioritize high-intent users in order to preserve the transactional nature of the category page.

This direction focused on users who were either close to applying or seeking reassurance before committing, using targeted content and clearer comparisons to support faster, more confident decision-making.

Why not the intent-led approach?

The intent-led approach offered broader support for different user needs, but conflicted with the category page’s role as a transactional entry point.

Prioritizing early intent identification required significant space above the fold, potentially distracting from high-intent users and weakening conversion performance.

1.

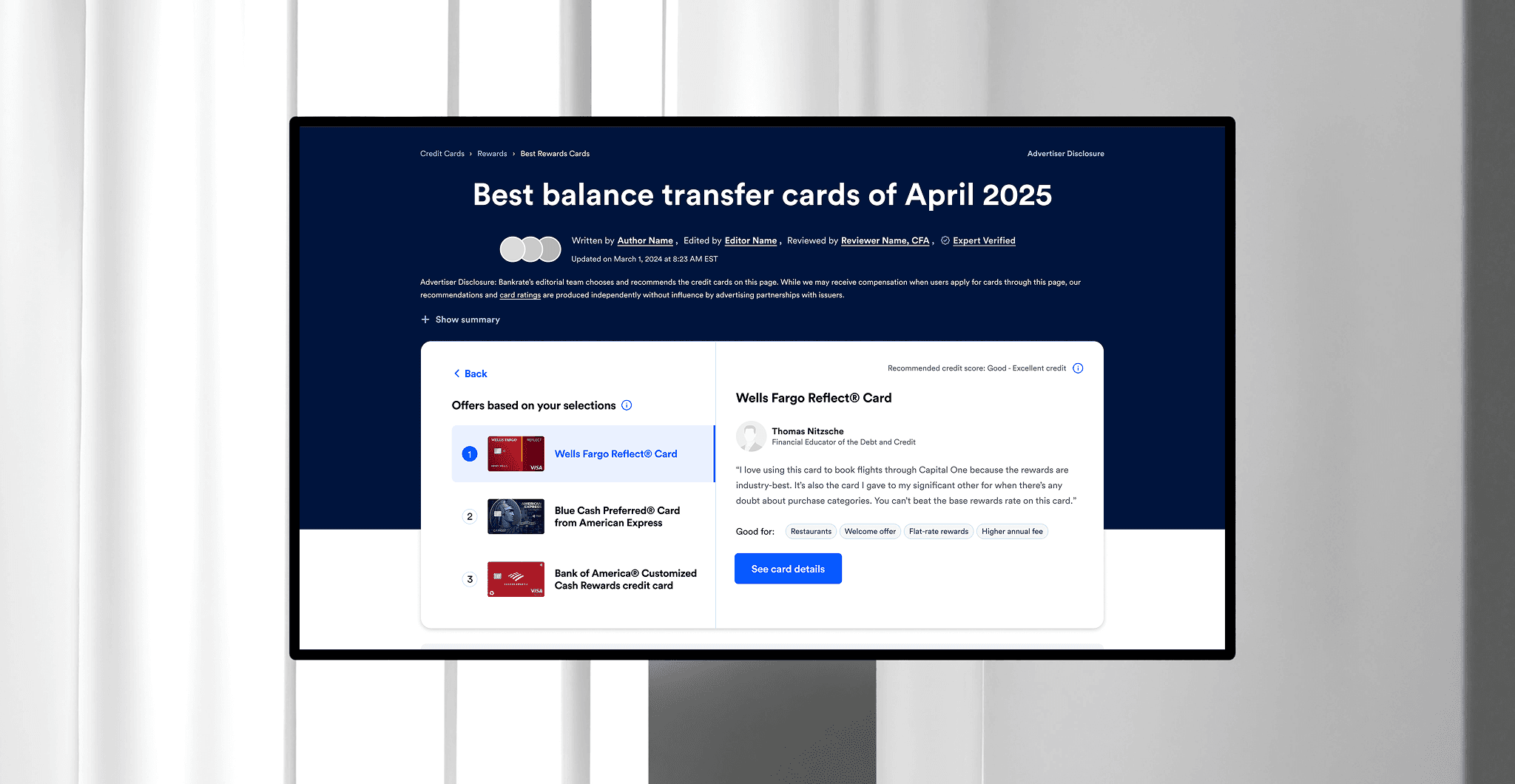

Prioritizing high-intent users with CardMatch

I introduced a CardMatch recommendation flow at the fold to immediately support high-intent users who were ready to act, while still offering clear guidance for those who needed reassurance before applying.

2.

Reducing low-value results in ranked lists

Research showed that cards ranked beyond the top five provided diminishing value and were a common drop-off point. I hid these lower-impact results by default, while still allowing users to reveal them if they wanted to explore further.

3.

Supporting decision-making beyond rankings

Beyond the top-ranked cards, the original page offered little support for users still deciding.

I introduced decision-supporting content earlier in the experience by adding in existing tools, data, and trust-signaling, like the balance transfer calculator and cards most popular with users, so users could answer key questions, build confidence, and continue toward conversion without leaving the page.

outcome

20% increase in click-through rate

Of the changes that we tested on the new balance transfer category page, there was about a 20% increase in click-through rate as well as a higher revenue-per-session.

Check out the live site

reflection

Next steps

Since we only launched the new page with some of the new features, the next step would be to incorporate more of the updates like automatically hiding cards or pulling in more relevant content below the featured cards and see how that would impact the existing site.

Bankrate credit card page engagement

Improved Bankrate’s credit card page experience through clearer structure and new components, increasing engagement and lifting click-through rates by 20%.

Role

Associate Product Designer

Skillset

Figma, Product Strategy

Team

2 Designers, 2 PMs

Timeline

2024-2025, 13 months

Overview

Bankrate’s credit card category pages are seeing a significant decline in engagement. Our team wanted to diagnose the issue and deliver a solution that would help engage more users while still keeping the focus on the largely transactional nature of the page.

Problem Framing

Credit card category pages are losing engagement

Bankrate’s credit card category pages significantly decline in engagement past the 5th featured credit card in the form of click through rate (CTR) and conversion rate (CR).

While it’s normal to assume that the amount of users that view each product further down the page may decrease, there is something that is causing a drop in viewers and massive drop off in conversion rate (~88%) past the 5th featured credit card.

Product Analysis

Understanding what our users actually want

Revisiting our credit card category pages and combing over user research regarding credit card users’ intents revealed 2 main insights:

1

Users always want to see the most relevant and personalized information to their own situation.

2

Users are arriving on credit card category pages with many different intents.

Diagnosis

What is broken about the current experience?

The credit card category page is optimized almost entirely around featuring cards and their benefits.

While this works for users who know exactly what they want, it falls short for those who arrive with different intents—such as learning how to use a card in a specific category or deciding which card is right for them.

After the first few top-ranked cards, additional cards provide diminishing value, making it harder for users to confidently choose or move forward.

Cards 6 & 7

Slightly relevant results

These results may be relevant for niche audiences.

Niche callouts

Average reviews

Average benefits

Cards 8-14

Rarely relevant results

These results may be relevant for niche audiences.

Lower-scoring reviews

Below-average benefits

Cards 1-5

Highly relevant results

Users are generally looking for these results.

Limited-time offers

High-scoring reviews

Great benefits

Strategy Exploration

Evaluating two strategic solutions

To address the key insights uncovered earlier and improve engagement on Bankrate’s credit card category pages, I explored two strategic approaches: each designed to support different user intents and business priorities.

1

Intent-led Approach

Focus primarily on addressing each user’s intent and triage their needs early on in the page.

2

Transactional Approach

Primarily target the users who are ready to convert by engaging them with content that will aid their decision-making process.

Final Solution

Prioritizing high-intent users

After reviewing both approaches with stakeholders, we chose to prioritize high-intent users in order to preserve the transactional nature of the category page.

This direction focused on users who were either close to applying or seeking reassurance before committing, using targeted content and clearer comparisons to support faster, more confident decision-making.

Why not the intent-led approach?

The intent-led approach offered broader support for different user needs, but conflicted with the category page’s role as a transactional entry point.

Prioritizing early intent identification required significant space above the fold, potentially distracting from high-intent users and weakening conversion performance.

1.

Prioritizing high-intent users with CardMatch

I introduced a CardMatch recommendation flow at the fold to immediately support high-intent users who were ready to act, while still offering clear guidance for those who needed reassurance before applying.

2.

Reducing low-value results in ranked lists

Research showed that cards ranked beyond the top five provided diminishing value and were a common drop-off point. I hid these lower-impact results by default, while still allowing users to reveal them if they wanted to explore further.

3.

Supporting decision-making beyond rankings

Beyond the top-ranked cards, the original page offered little support for users still deciding.

I introduced decision-supporting content earlier in the experience by adding in existing tools, data, and trust-signaling, like the balance transfer calculator and cards most popular with users, so users could answer key questions, build confidence, and continue toward conversion without leaving the page.

Outcome

20% increase in click-through rate

Of the changes that we tested on the new balance transfer category page, there was about a 20% increase in click-through rate as well as a higher revenue-per-session.

Check out the live site

Reflection

Next steps

Since we only launched the new page with some of the new features, the next step would be to incorporate more of the updates like automatically hiding cards or pulling in more relevant content below the featured cards and see how that would impact the existing site.

Next project